Will Filing Chapter 7 Bankruptcy Ruin My Life Fundamentals Explained

In the event your credit score rating is not sufficient to create personal debt consolidation worthwhile or your payments on the credit card debt consolidation loan or harmony transfer card remain unaffordable, a financial debt administration strategy may be worth taking into consideration.

You have to fulfill a couple of requirements and soar via some hoops to file Chapter seven bankruptcy. But as long as you satisfy all the necessities, your Chapter 7 bankruptcy discharge is sort of guaranteed.

Moreover, consider registering for Experian's free of charge credit monitoring assistance, which provides usage of your FICO® Rating☉ and Experian credit score report, in conjunction with true-time alerts when changes are made to the report.

Editorial Coverage: The information contained in Inquire Experian is for academic reasons only and is not lawful information. You need to consult your personal lawyer or search for particular tips from a lawful Experienced concerning any authorized difficulties.

The rest will be eradicated as soon as the bankruptcy is discharged, commonly within four to 6 months.

Personal debt settlement entails negotiating with the lenders to pay a lot less than what you owe. You may ordinarily undergo a personal debt settlement business, but you can select to negotiate by yourself.

The government models answerable for issuing and renewing licenses commonly consider the All round picture from an applicant when making conclusions about issuing licenses.

When your economical difficulties imp source are shorter-term in character, look at inquiring some of your creditors about forbearance or deferment. These alternatives ordinarily include pausing your month to month payments for a find out brief period of time—ordinarily only a few months—providing you with a while to receive again on the financial ft.

Your employer also can’t reduce your salary, demote you, my blog or Provide you decrease duties at operate. This is real whether you work for that federal governing administration, state authorities, or A non-public corporation.

You'll really have to Reside in this finances for up to 5 many years. site link For the duration of that point the court docket will continually Check out your paying out, and will penalize you seriously if you aren't adhering to the system. Seem like enjoyment? To top it off, it will stay on your file for 7 several years.

Precisely the same was correct four quarters, or one calendar year, after filing bankruptcy. People today are thought of insolvent when their debts exceed their property.

They make anything uncomplicated and anxiety totally free and also teach you Together with the comprehensive strategy they have set up. I Couldn't provide them with a substantial adequate review. Thanks Upsolve!

A low credit score here refers to credit look at here now scores which can be beneath 600. When you fit this credit score profile, it’s also far more most likely you’ll have entry to a number of traces of credit history in the year adhering to your bankruptcy.

If you're thinking about filing for bankruptcy, you're not by yourself. Every year, numerous countless numbers of people file for bankruptcy thanks to their overwhelming financial debt.

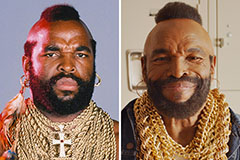

Mr. T Then & Now!

Mr. T Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!